Get Behind the Wheel of Elegance: Varsity Lincoln Car Dealership Exclusives

Wiki Article

Why Automobile Leasing Can Be the Right Choice for You

Thinking about the myriad of alternatives available when it comes to acquiring a lorry, one technique that typically sticks out is car leasing. The decision to select a lease can be a tactical one, specifically for those that value flexibility and cost-efficiency. With lower regular monthly settlements and the allure of driving a brand-new car, leasing emerge as an intriguing alternative to conventional cars and truck possession. However, there are other compelling reasons why cars and truck leasing can possibly be the ideal suitable for you.

Lower Regular Monthly Settlements

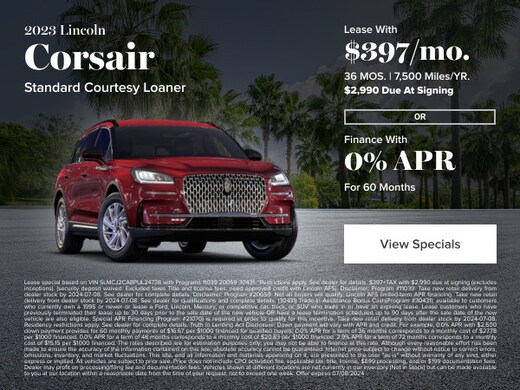

When taking into consideration vehicle leasing, one advantage that commonly attracts attention is the possibility for dramatically reduced month-to-month settlements contrasted to funding a vehicle. Leasing allows individuals to drive a brand-new car without the hefty deposit required for purchasing. The monthly payments in a lease are typically based on the vehicle's devaluation throughout the lease term, instead than the complete purchase price. This can result in reduced month-to-month expenses, making it an appealing choice for those wanting to keep their month-to-month expenditures workable.Lower month-to-month payments can additionally supply the opportunity to drive a higher-end lorry that could be financially unreachable with conventional funding. By spreading out the price of depreciation over the lease term, people can take pleasure in the benefits of a more recent, much more luxurious auto without the long-lasting dedication that includes possession. Furthermore, renting typically consists of guarantee insurance coverage throughout of the lease, lowering the monetary burden of unforeseen repairs. On the whole, the appeal of reduced monthly repayments in vehicle leasing exists in its ability to supply flexibility and price to consumers (varsity lincoln).

Marginal Maintenance Prices

One of the attractive facets of automobile leasing, past the advantage of lower month-to-month payments, is the capacity for marginal maintenance expenses throughout the lease term. When you rent a vehicle, you are commonly driving a car that is brand-new or a few years of ages. This suggests that the car is still under the maker's service warranty, covering most, otherwise all, of the mechanical issues that may occur during the lease duration. With this service warranty insurance coverage, you can stay clear of the high costs frequently related to significant fixings. In addition, rented vehicles typically need less maintenance compared to older automobiles, as they remain in their prime problem when you begin driving them. Regular maintenance like oil modifications, tire turnings, and fluid checks are normally the level of what you require to bother with throughout the lease, conserving you money and time on unanticipated fixings. On the whole, marginal upkeep prices can make car leasing an eye-catching alternative for those aiming to stay clear of the economic problem of maintenance that includes owning a vehicle.Chance for New Automobiles

Having the opportunity to drive brand-new automobiles is an essential benefit of going with automobile leasing over traditional possession. When you choose to lease an auto, you are essentially becoming part of a contract that permits you to make use of a brand-new vehicle for a collection period, normally ranging from 2 to 4 years. This means that you can take pleasure in the most up to date technology, security functions, and stylish layouts without the long-term dedication of owning an auto.Leasing gives the chance to drive a new car extra frequently than if you were to buy one outright. lincoln dealers. As soon as your lease term is up, you can just return the lorry and rent a new design, maintaining up with the most up to date developments in the vehicle sector. This cycle of driving brand-new vehicles every few years can be interesting those that appreciate having access to the newest developments and upgrades without the headache of marketing or trading in a possessed vehicle

Furthermore, leasing enables you to experience a range of cars and trucks from various suppliers, allowing you to explore and find the ideal suitable for your choices and way of living. This adaptability to switch between cars provides a level of flexibility and exhilaration that ownership may not offer.

Flexible Terms

Versatility in terms is a specifying feature of automobile leasing arrangements, permitting tailored setups to match specific needs and preferences. One of the primary advantages of auto leasing is the capacity to tailor the regards to the lease to line up with your particular requirements. This flexibility reaches numerous elements of the contract, such as lease duration, gas mileage limitations, and extra services.Lease period is a crucial component where flexibility beams. Unlike Visit Your URL standard vehicle ownership, which commonly extends a number of years, renting supplies the choice of shorter lease terms, usually varying from 24 to 48 months. This is beneficial for individuals that choose driving newer automobiles much more frequently or that have developing transport requirements.

Furthermore, renting enables modification relating to mileage limitations. By selecting a gas mileage allowance that straightens with your actual driving behaviors, you can prevent excess gas mileage fees at the end of the lease term. In addition, some leasing contracts supply the opportunity of acquiring additional miles in advance or adjusting the limitation throughout the lease period.

Moreover, many leasing agreements provide the choice to consist of additional solutions, such as upkeep plans or roadside help, permitting lessees to delight in a thorough and hassle-free driving experience. This versatility in terms makes car leasing a adaptable and useful selection for many consumers.

Economical Alternative

When considering automobile leasing, the monetary element commonly attracts attention as a cost-effective option for many consumers. Choosing an automobile lease normally needs a lower preliminary deposit compared to purchasing a vehicle outright. This can be particularly attractive for individuals that could not have a large sum of cash readily available for a deposit but still desire accessibility to a brand-new lorry. In addition, month-to-month lease repayments are commonly reduced than financing payments for an acquired vehicle, making it an extra budget-friendly selection for those wanting to manage their capital efficiently.

Renting permits people to drive a brand-new car every few years without the trouble of selling or trading in an automobile, conserving on devaluation expenses. These economic advantages make car leasing an appealing choice for budget-conscious consumers looking for a cost-effective and dependable method to access a car.

Final Thought

With lower monthly payments and the appeal of driving a brand-new car, leasing presents itself as an appealing option to conventional automobile ownership. When you lease a car, you are generally driving a vehicle that is brand name brand-new or just a few years old. Additionally, rented lorries check my blog normally need less upkeep contrasted to older cars and trucks, as they are in their prime condition when you start driving them. Unlike typical auto important link possession, which usually spans several years, renting provides the option of much shorter lease terms, commonly ranging from 24 to 48 months. Leasing permits individuals to drive a brand-new cars and truck every few years without the hassle of marketing or trading in a car, conserving on devaluation costs.

Report this wiki page